With the average 30-year fixed mortgage rate from Freddie Mac climbing above 3%, rising rates are one of the topics dominating the discussion in the housing market today. And since experts project rates will rise further in the coming months, that conversation isn’t going away any time soon.

But as a homebuyer, what do rates above 3% really mean?

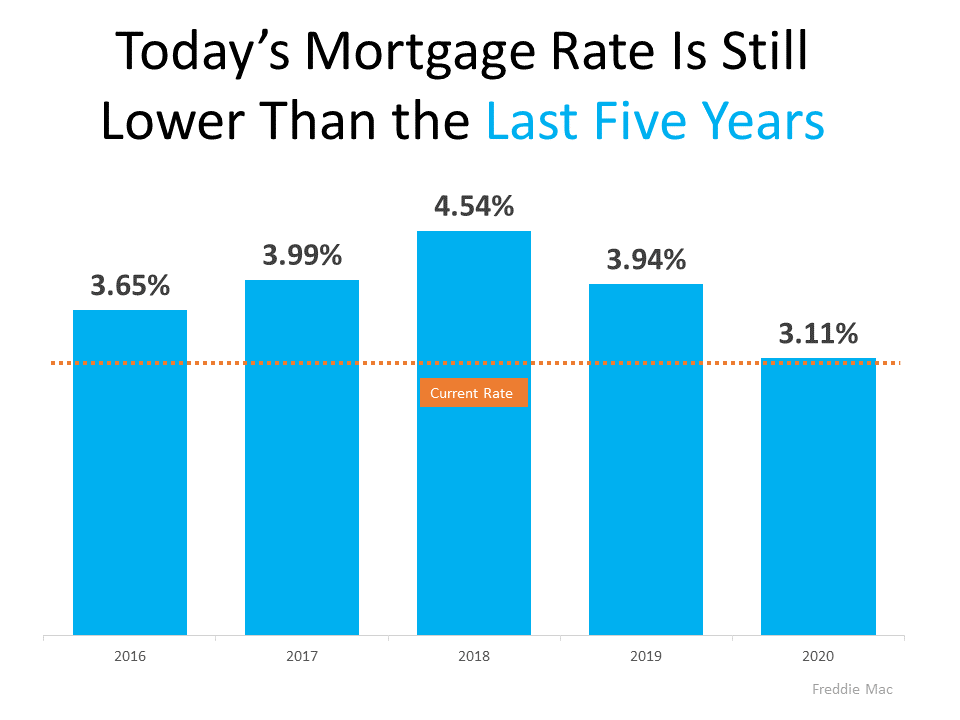

Buyers don’t want mortgage rates to rise, as any upward movement increases your monthly mortgage payment. But it’s important to put today’s average mortgage rate into perspective. The graph below shows today’s rate in comparison to average rates over the last five years: As the graph shows, even though today’s rate is above 3%, it’s still incredibly competitive.

As the graph shows, even though today’s rate is above 3%, it’s still incredibly competitive.

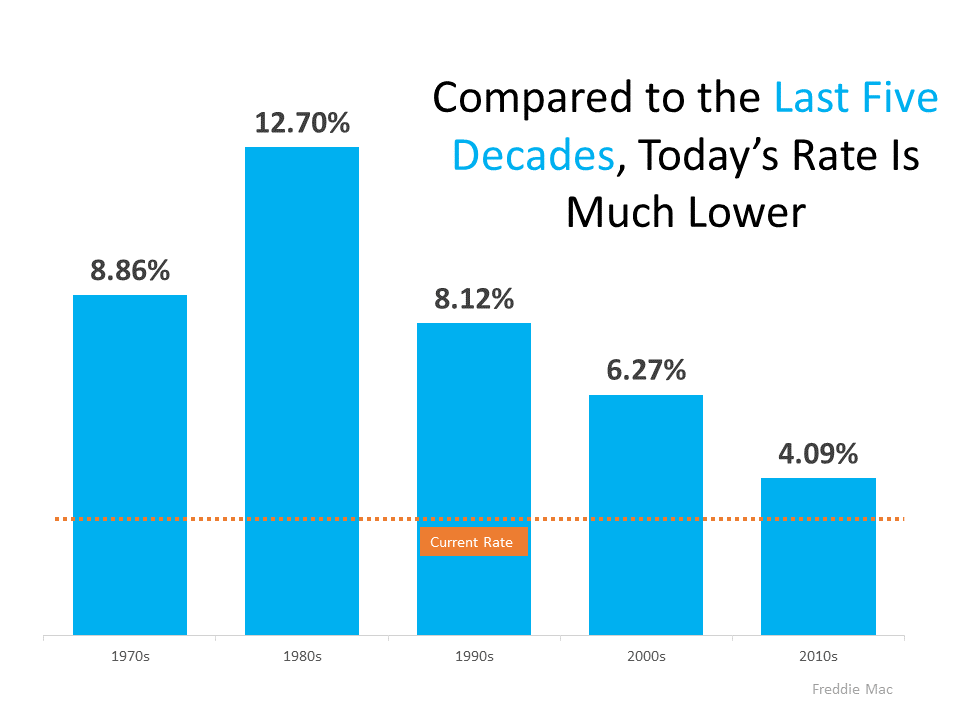

But today’s rate isn’t just low when compared to the most recent years. To truly put today into perspective, let’s look at the last 50 years (see graph below): When we look back even further, we can see that today’s rate is truly outstanding by comparison.

When we look back even further, we can see that today’s rate is truly outstanding by comparison.

Being upset that you missed out on sub-3% mortgage rates is understandable. But it’s important to realize, buying now still makes sense as experts project rates will continue to rise. And as rates rise, it will cost more to purchase a home.

As Mark Fleming, Chief Economist at First American, explains:

“Rising mortgage rates, all else equal, will diminish house-buying power, meaning it will cost more per month for a borrower to buy ‘their same home.’”

In other words, the longer you wait, the more it will cost you.

While it’s true today’s average mortgage rate is higher than just a few months ago, 3% mortgage rates shouldn’t deter you from your home buying goals. Historically, today’s rate is still low. And since rates are expected to continue rising, buying now could save you money in the long run. Let’s connect so you can lock in a great rate now.

The purpose of Veterans Affairs (VA) home loans is to provide a pathway to homeownership for those who have sacrificed so much by serving our nation. As the Veterans Administration says of the program: “The objective of the VA Home Loan Guaranty program is to help eligible Veterans, active-duty personnel, surviving spouses, and members of the Reserves and National Guard purchase, retain, and adapt homes in recognition of their service. . . .” For over 75 years,...

How Smart Buyers Are Approaching Rising Mortgage Rates Last week, the average 30-year fixed mortgage rate from Freddie Mac inched up to 3.1%, and experts project rates will continue rising through 2022: “The 30-year fixed-rate mortgage was 2.9% in the third quarter of 2021. We forecast mortgage rates to increase slightly through the remainder of the year and reach 3.0%, rising to 3.5% for full year 2022.” If you’re thinking of buying a home, here are a few things to...