When individuals or couples go house-hunting, they do it with the goal of finding their dream home. Whether it’s a ranch-style home, a farmhouse-style residence, or a home with a more contemporary and modern feel, personal preferences are a driving factor in the real estate market. It’s these preferences that can push prospective homeowners in two different directions: buying a home or building one. Both options have their strengths and drawbacks, and for you to make the most informed decision possible, our team is here to break down the realities of buying and building.

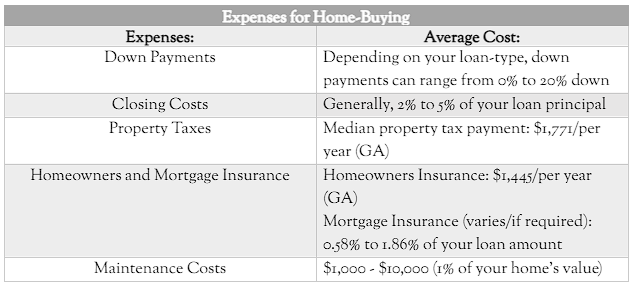

It’s rare that a buyer will find a home that’s a perfect fit for them, but it is possible. Usually, however, buyers will see a home that might be close to what they are looking for and resolve to remodel or replace the remaining differences to their liking. Yet, there are still many moving parts to address when we talk about the process of buying a home, and expenses are the most important aspect to touch on because they are the primary determining factor for house-hunting. As a result, our team has compiled a list of common expenses you’ll see:

-Down Payments: Unless homeowners are paying in full with cash, they’ll need to put forth a down payment for their home before paying the rest through their mortgage. There are several loan options available, including conventional loans, FHA loans, VA loans, and USDA loans—which can depend on a home’s price, property type, and the loan lender. Yet, while conventional and FHA loans can have down payments ranging from 3% to 3.5%, VA and USDA loans—which are geared towards veterans and rural buyers, respectively—can offer loans for 0% down.

-Closing Costs: Closing costs can include appraisal fees, home inspection costs, title search and insurance fees, transfer taxes, credit check fees, and more. You can expect closing costs to equal roughly 2 to 5 percent of your loan principal.

-Property Taxes: Property taxes, decided by the city and its tax rate, are determined by your home’s assessed value. An appraisal sets the value of your home, and once this occurs, you will be responsible for paying the property tax included in your monthly mortgage payment according to the city’s percentage. However, keep in mind that your property tax could increase due to market conditions, or your home being reassessed at a higher value.

-Homeowners and Mortgage Insurance: Homeowners insurance varies by state and company. Nationwide, State Farm, Progressive and more all have different packages so comparing offers is key. Most lenders require homeowners’ insurance. In contrast, mortgage insurance is needed for down payments of less than 20%, but this fee tacked on to your mortgage payment. Mortgage insurance is determined by your credit score and your initial down payment and can be discontinued once you reach 20% equity.

-Maintenance Costs: Funds should always be set aside for home maintenance, though that amount will depend on the condition of the home, the personal changes you’d like to make, and any repairs that must be done. Generally, it’s recommended that homeowners allocate approximately one percent of their home’s value for any fixes.

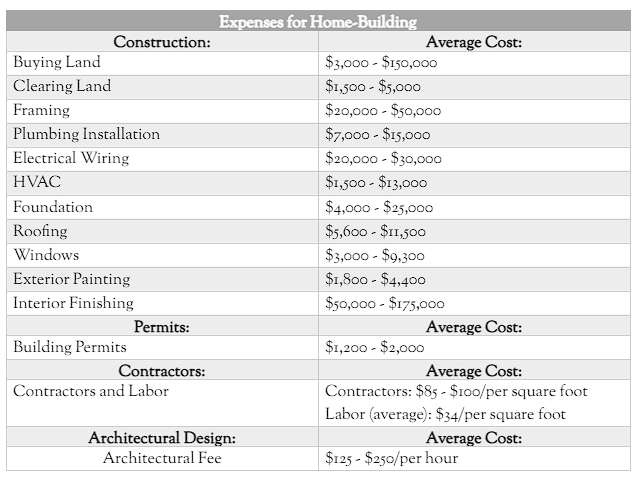

Building a home is an attractive alternative if you want to ensure all your preferences are built into the residence you’ll live in for years to come, but several factors must be considered. Your house must be mapped out architecturally, permits must be acquired, contractors and labor have to be decided on, materials have to be chosen, and even construction loans have to be negotiated.

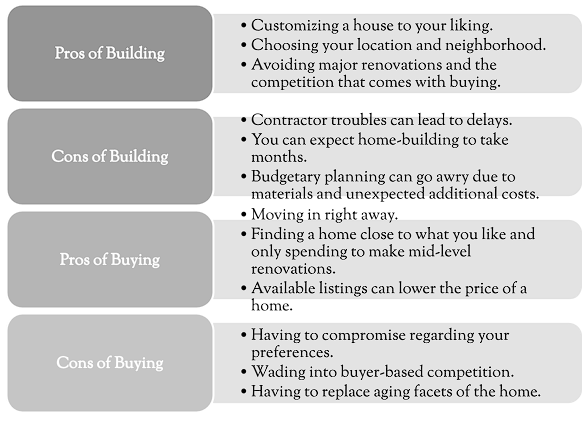

Is it cheaper to build or buy a house? As you can see, choosing to build or buy a home is a complex decision that carries tradeoffs and compromises on both sides. In some ways, buying a home is simpler. In other ways, building a home catered to their preferences is worth it to buyers. To help unpack the variables in play, here is a quick rundown from our team of the pros and cons before you decide.

Several things to consider when deciding to buy a home can include moving costs, Homeowners Association costs if you choose to live in an HOA-friendly neighborhood. In addition, it’s good to keep in mind that if your chosen home is larger, the cost of your utility bills rises.

On the other hand, with so much variation and indeterminate factors tied to home-building, you’re in for a bigger gamble. Ever-changing material costs and labor rates can affect construction timelines and the final price of your home. According to HomeAdvisor, on average, the cost of a newly built home, complete with all of a buyer’s preferences, can range from as low as $117,050 to as high as $451,362, with the national average coming in at $283,984.

Therefore, if you’re a buyer that wishes to live in your dream home, there is a lot to consider when it comes to making the choice to buy or taking the leap and choosing to build to ensure your home is tailored to your wants and needs. We hope this breakdown has shed light on both processes and has provided more clarity as you navigate these tricky decisions.

https://www.bankrate.com/insurance/homeowners-insurance/homeowners-insurance-cost/

https://www.homelight.com/blog/average-home-maintenance-costs/

https://www.bankrate.com/mortgages/costs-of-buying-a-home/

https://www.nerdwallet.com/article/mortgages/really-costs-buy-home

https://homeguide.com/costs/cost-to-build-a-house#labor

By: Jennifer Estrada Oftentimes, when we think of sprucing up our homes, we usually do it for several reasons, including wanting an aesthetic shake-up after a significant amount of time with the same design scheme, or we remodel with the intention of increasing the value of the home. Giving your home a fresh coat of paint is a great way to achieve both goals while also exercising your creative muscles. However, before going ahead, it’s...

Imagine life in a neighborhood nestled right in the heart of Georgia, surrounded by greenery and outdoor activities, with access to the kinds of conveniences and attractions you can only get in the city. Macon, Georgia offers culture, entertainment, shopping, and all the services you’ll need for life to flourish. And, for some lucky homebuyers, it’s also host to a number of communities from our exceptional builder partners. New homes are available for sale now...